CFA Investing in ESG

Emerging Market Financial Training provides CFA Investing in ESG training which embeds classroom training, tests and mocks.

The program is customised based on the requirements of the business and the individual and regular feedback is provided based

on a predetermined set of goals and objectives.

About this Course

The training program will be customized according to the client’s specific needs and goals, aiming to maintain or enhance proficiency in areas of strength. Progress tests will be conducted through our online platform, allowing us to closely monitor individual progress while enabling participants to track their advancement.

Additionally, a comprehensive mock assessment will be administered at a predetermined stage to promptly identify any potential issues and identify both strengths and weaknesses.

Who should attend?

The purpose of this certification is to cater to investment professionals seeking to expand their knowledge on analyzing and incorporating significant ESG elements into their daily responsibilities. It is applicable for individuals working in various capacities such as sales, wealth management, product development, financial advisory, consulting, data science, and risk analysis. Furthermore, it is valuable for anyone aiming to enhance their comprehension of ESG matters. It is advisable to possess a fundamental understanding of the investment process, either through formal qualifications or practical experience.

Study Program

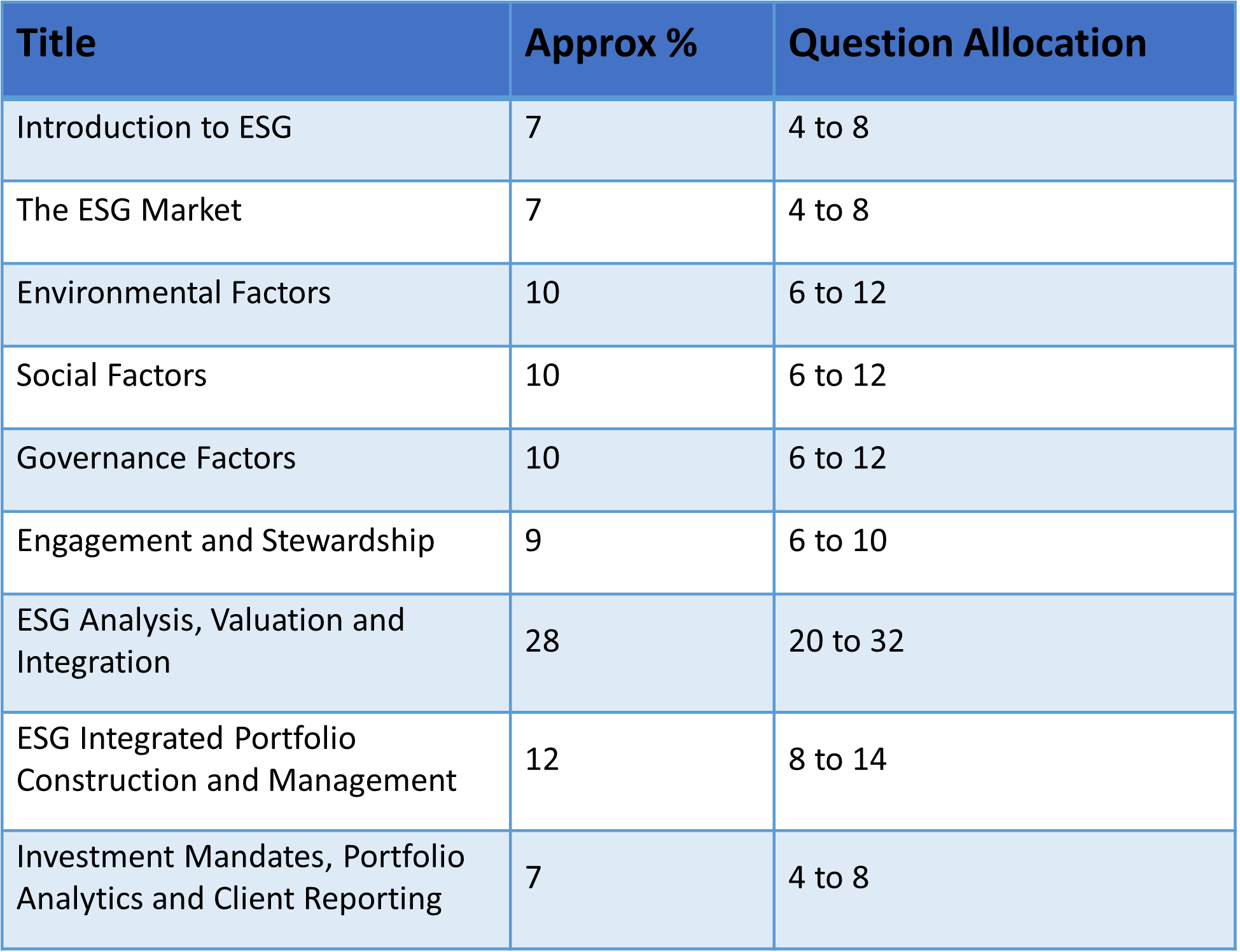

Module 1: Introduction to ESG

Module 2: The ESG Market

Module 3: Environmental Factors

Module 4: Social Factors

Module 5: Governance Factors

Module 6: Engagement and Stewardship

Module 7: ESG Analysis, Valuation and Integration

Module 8: ESG Integrated Portfolio Construction and Management

Module 9: Investment Mandates, Portfolio Analytics and Client Reporting

Topic and Weightage

Overview of the ESG exam

-

- Number of questions: 100

- Time allowed: 2 hours 20 minutes (or 140 mins)

- Exam question style: 100 Multiple choice

- Weighting: 1 mark per question, no negative marking

- Target pass mark: 60% to 70%

- Pass rate: 60% to 75%

- Examiner: CFA Institute