Chartered Financial Analyst (CFA)

CFA ® Institute is a global association of investment professionals. The organization offers the Chartered Financial Analyst ® (CFA) designation.

The charter gives a strong understanding of advanced investment analysis and real-world portfolio management skills.

Are you eligible to pursue the CFA Certification?

In order for you to start off your CFA, and successfully become a charter holder, you need to meet at least one of the following criteria:

-

-

Holding a bachelor’s degree (equivalent to 3 or 4 years)

-

Be in your final year of college or bachelor’s programme

-

Qualified professional work experience of over four years

-

Combined college and work experience of at least four years

-

Additionally, you must apply for a membership in a CFA society while also being an active member of the CFA Institute.

Levels & Curriculum

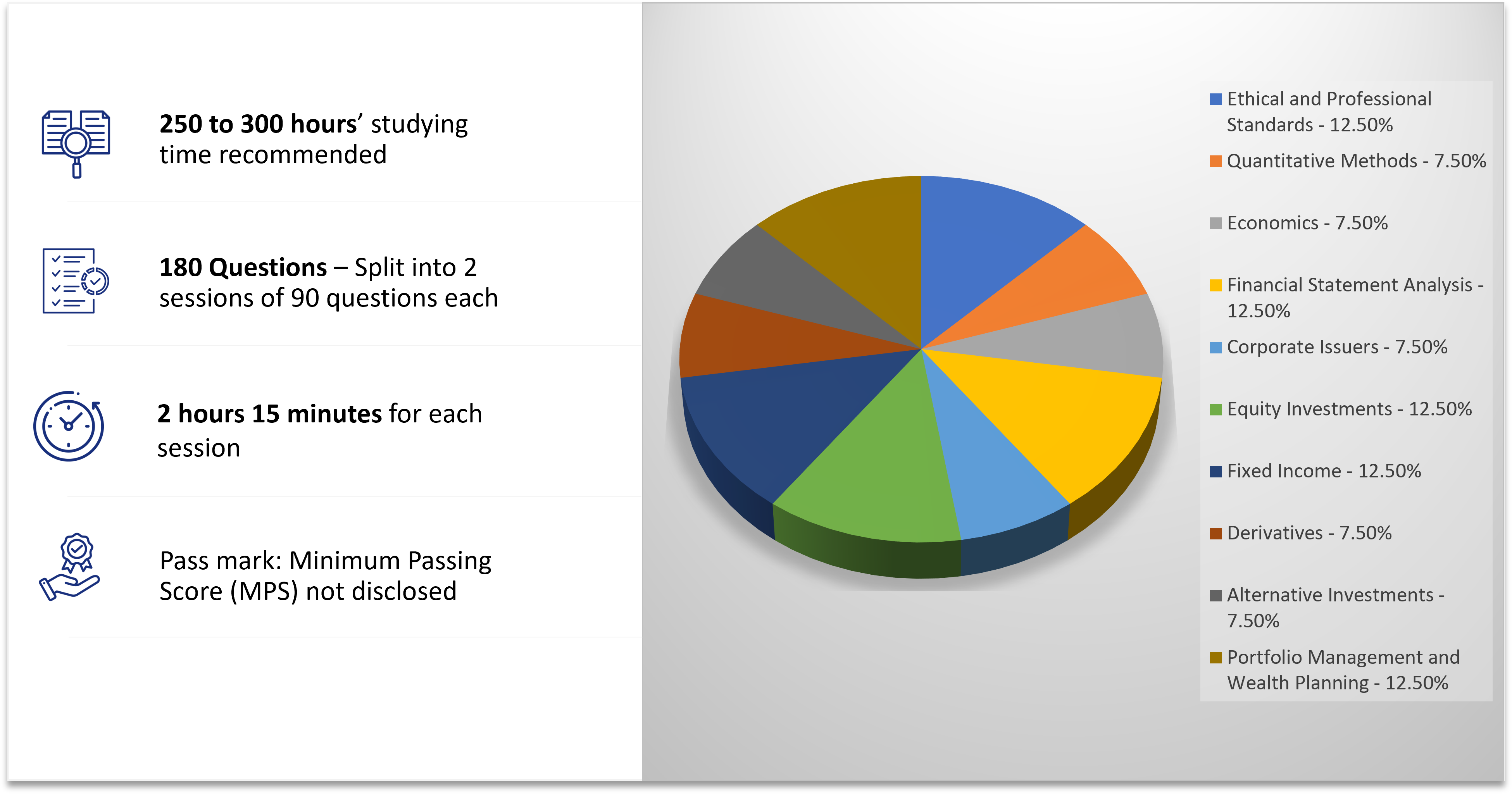

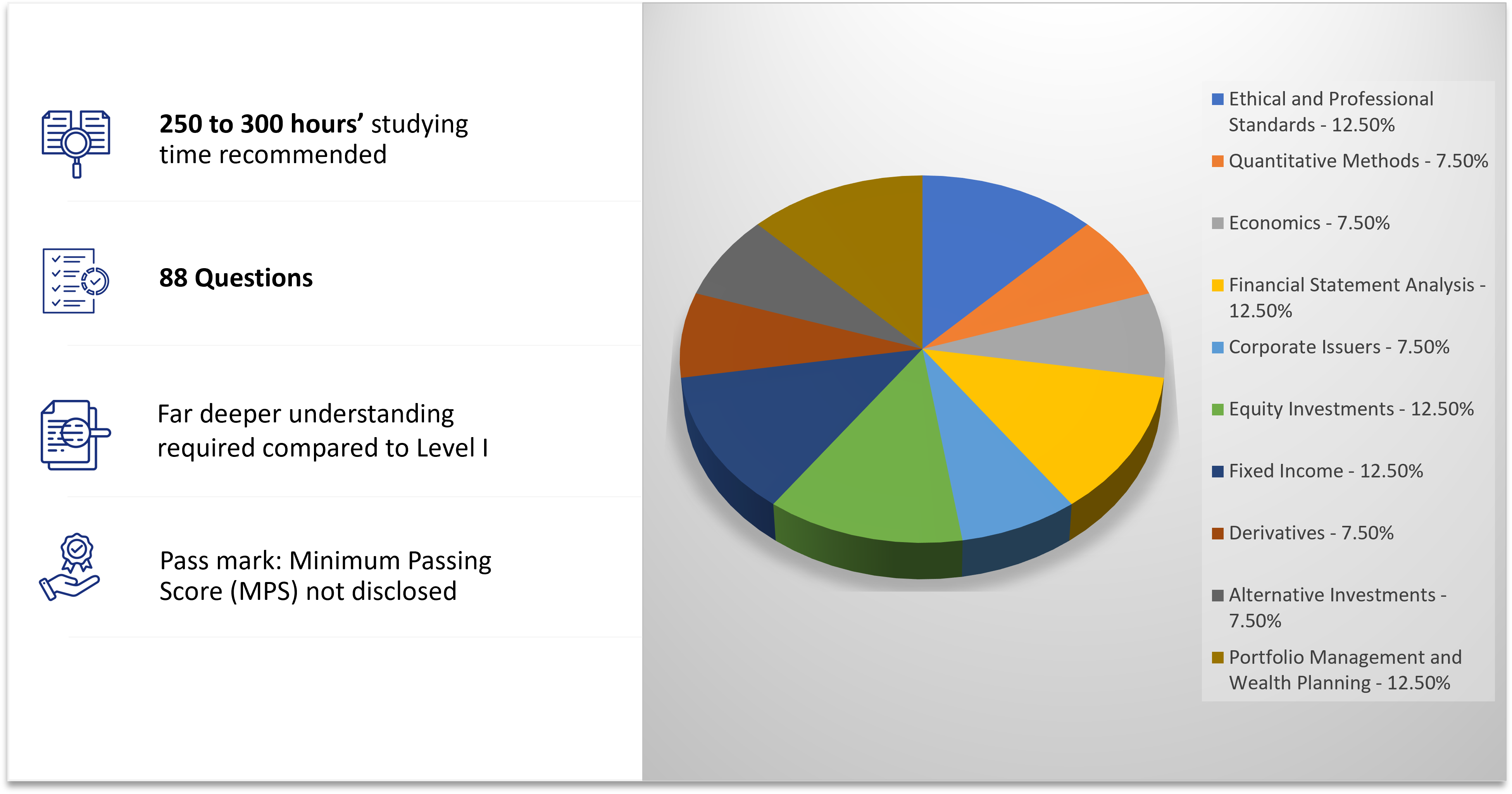

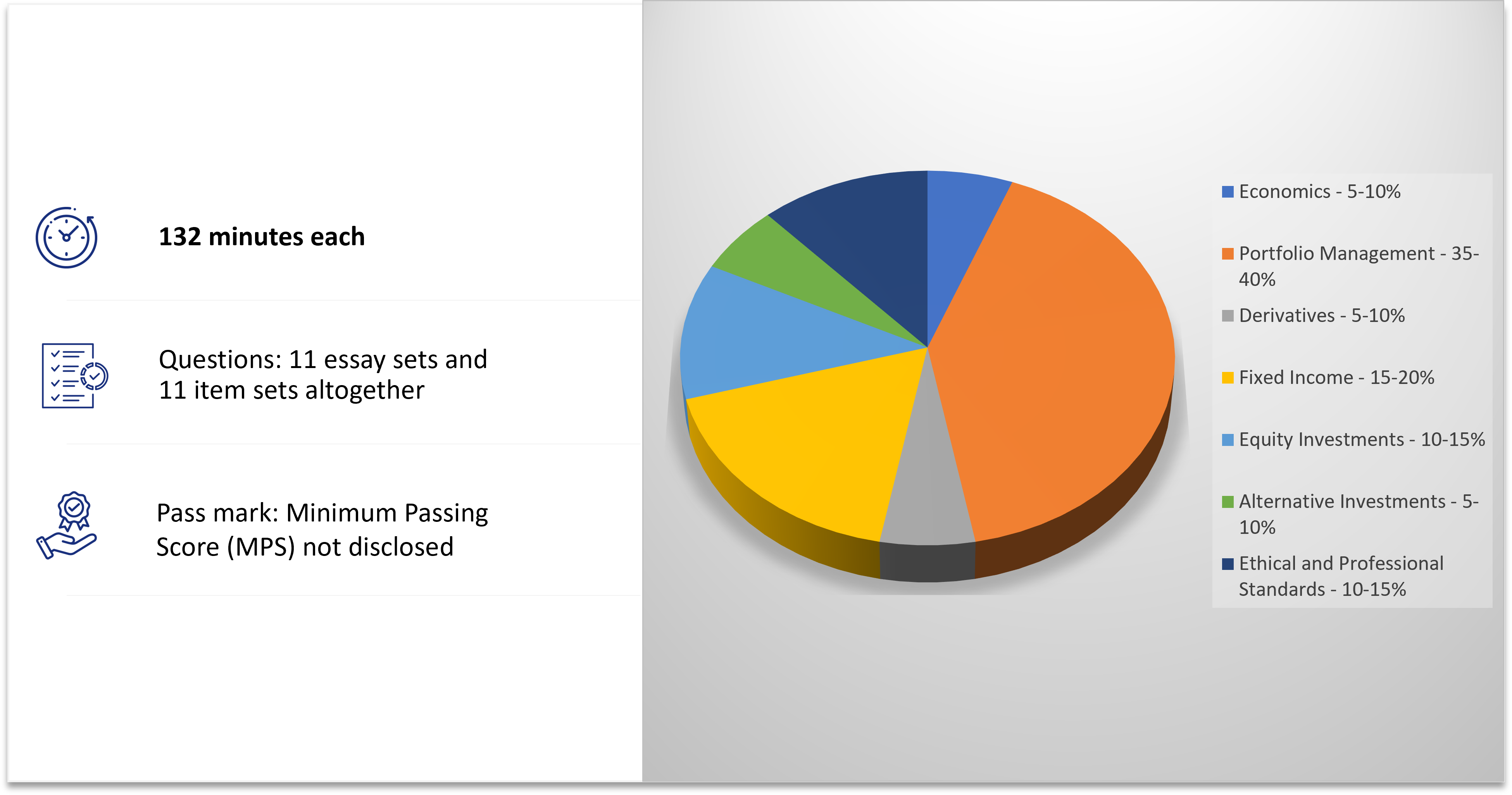

The CFA is divided into three separate levels (Levels 1, 2 & 3); each of which can be taken once a year. The only exception being that the CFA Level 1 exam takes place twice a year i.e. in June and December whereas CFA Levels 2 and 3 are held only in June every year.

Each of these exams must be passed sequentially, with the complexity of each of them increasing up the levels.

The modules for CFA Level I are as follows:

The modules for CFA Level II are as follows:

The modules for CFA Level III are as follows:

Why study for this certificate?

The certificate provides a range of benefits including:

-

-

An opportunity to increase one’s expertise and investment knowledge

-

An opportunity to analyze investments from a holistic perspective

-

A strong understanding of each investment asset class

-

A wealth of career opportunities within the investment industry

-

Global recognition within the finance and investment industry

-