Syllabus, Exam Weighting and Pre-Assessment

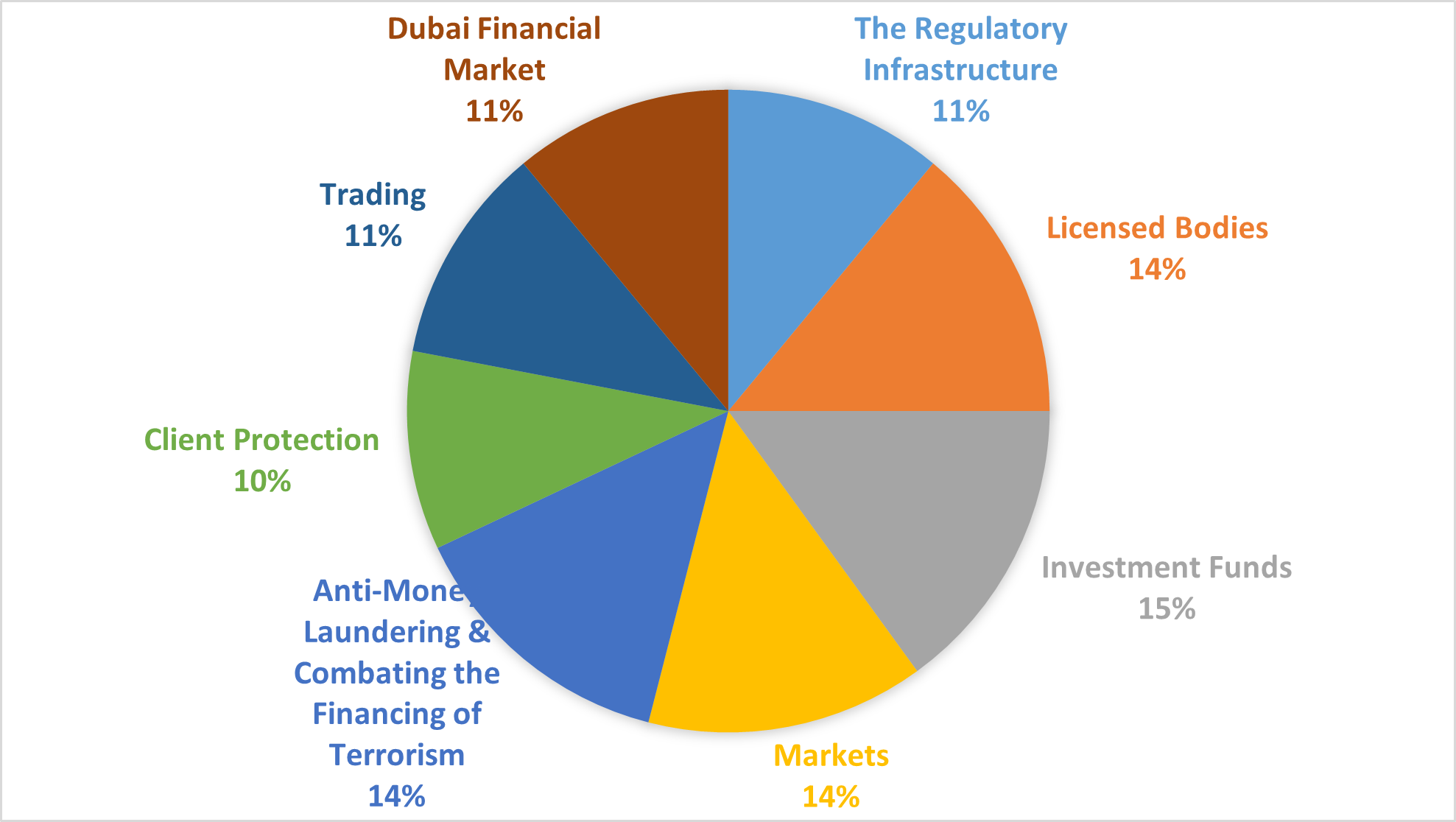

The following chapter and exam weighting should guide your study time.

We highly recommend you read the course text in conjunction with our slides providing you more exam focus.

If you have any questions on the content or admin related questions please email us at cisi@emergingmarketft.com

Happy studying!

We have designed a pre-assessment to track your understanding of the material from the pre-readings. We highly recommend you to take the pre-assessment to get an idea of where you stand.